2026 Most Asked Questions of Charlottesville Real Estate

In 2026, the most frequently asked questions regarding Charlottesville real estate will center on shifting market conditions, property assessments, and the unique influence of the University of Virginia (UVA).

Current Market Trends (2026): Is Charlottesville real estate a buyer’s or seller’s market?

It remains a seller’s market due to limited inventory, though conditions are gradually shifting as active listings have increased by over 30% compared to 2025.

What is the average home price?

As of late December 2025, the median sales price in Charlottesville is approximately $485,000 to $550,000, depending on the neighborhood and proximity to downtown.

How fast are homes selling?

Demand remains high, with many homes going under contract in an average of 9 to 11 days.

Charlottesville Property & Tax Assessments

How are property values determined?

The City of Charlottesville assesses all real estate annually at fair market value, primarily using the “market approach” (comparing recent sales of similar properties).

How can I appeal my assessment?

Owners can submit an Assessment Appeal Application to the City Assessor’s Office if they believe the valuation exceeds true market value or contains factual discrepancies.

What is the current tax rate?

For 2026, the tax rate is $0.98 per $100 of assessed value, with payments due twice yearly on June 5 and December 5.

Buying & Lifestyle

Which neighborhoods are most walkable?

Popular areas within walking distance of UVA and the Downtown Mall include:

Belmont

Fry’s Spring

North Downtown

Rugby

How does UVA affect the market?

The university drives a massive rental market (roughly 59% of residents are renters) and maintains high property values for homes within its immediate vicinity.

Is Charlottesville a good investment?

Yes, the stable presence of UVA and strong rental demand continue to support long-term investment opportunities for both traditional and vacation rentals.

Development & Zoning

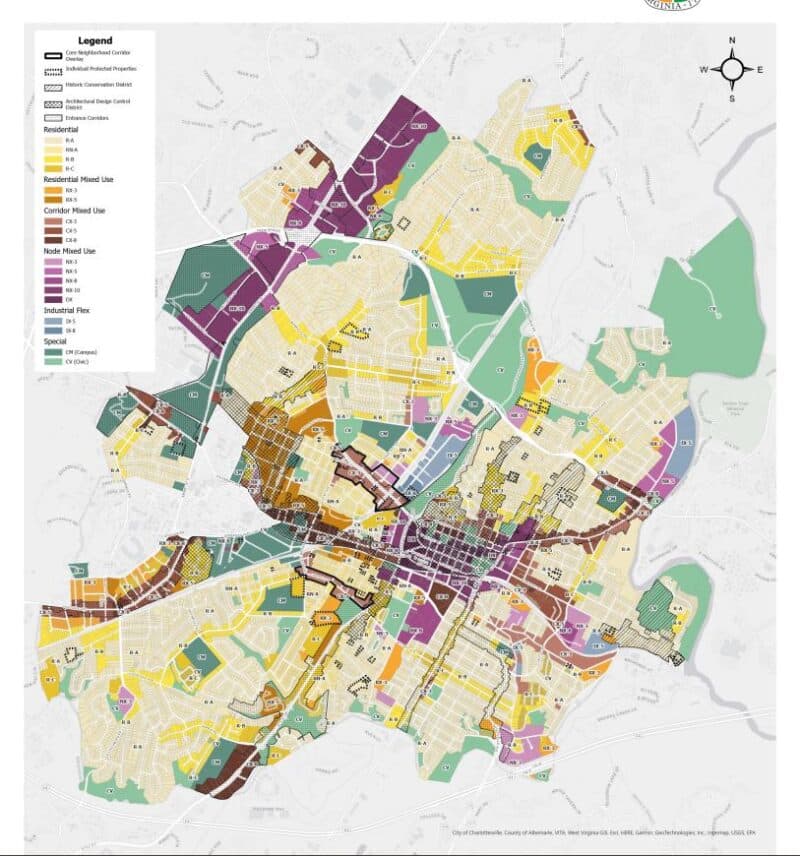

Can I subdivide my property?

This depends on the specific Zoning Map district.

Recent updates to the Development Code have simplified requirements for building multiple housing units on a single property in certain districts.

Where can I see new developments?

Residents can use the city’s Development Viewer to track active applications and construction projects in their neighborhood.

To appeal a property assessment in Charlottesville in 2026, homeowners typically follow a multi-step administrative process focused on proving that their property is overvalued, inequitably assessed, or contains factual errors.

Step 1: Informal Contact

Homeowners are encouraged to first contact the City Assessor’s Office at 434-970-3136.

This allows them to speak directly with the appraiser responsible for the assessment to understand how the value was determined and clarify any immediate concerns.

Step 2: Administrative Review (City Assessor)

If informal contact does not resolve the issue, the homeowner must file a formal Assessment Appeal Application.

Deadline: For 2026 assessments, this must be filed by February 28, 2026.

Required Evidence: The homeowner must provide documentation such as:

Market Data: Sales records of at least three similar properties that occurred in the previous calendar year (2025 for a 2026 appeal).

Inequity Proof: Assessments of at least three similar nearby properties to show lack of uniformity.

Factual Errors: Proof of incorrect square footage, lot size, or property condition (e.g., photos of needed major repairs).

Outcome: An assessor will review the application, which may include a physical inspection, and issue a written decision within 30 days.

Step 3: Board of Equalization (BOE)

If the homeowner disagrees with the Assessor’s final decision, they can escalate to the Board of Equalization, an independent panel of citizens.

The Charlottesville Board of Equalization (BOE) is a citizen panel that hears appeals for real estate assessments, helping to ensure fairness and accuracy by increasing or decreasing values if evidence shows they’re inequitable or don’t match market value/property records.

It’s the step after the initial City Assessor review, requiring a formal application within 30 days of the assessor’s decision and involving hearings where owners present evidence of factual errors or inconsistencies with similar properties.

Deadline: The appeal must be filed within 30 days of receiving the Assessor’s formal decision letter.

Process: The BOE holds public hearings where the homeowner presents evidence.

They have the authority to increase, decrease, or affirm the assessment.

Step 4: Circuit Court

The final option is to apply for relief to the Charlottesville Circuit Court.

This is a formal legal proceeding where the burden of proof falls entirely on the homeowner to show the assessment is erroneous.

Homeowners must also pay all associated court costs.

Key Contacts for Charlottesville Appeals:

City Assessor’s Office: 102 5th St. NE, Charlottesville, VA 22902 | 434-970-3136

Online Application: Homeowners can file an Assessment Appeal Application online.

Successful property assessment appeals in Charlottesville typically rely on providing concrete evidence of factual discrepancies, demonstrating that the assessment exceeds true market value, or showing a lack of uniformity with comparable properties.

Factual Discrepancies

Appeals are often successful when the homeowner can prove that the City Assessor’s records contain errors regarding the property’s physical characteristics.

Incorrect Square Footage: The recorded building or lot size is wrong.

Property Condition: The assessment fails to account for significant damage, unfinished areas, or a deteriorated condition (e.g., a leaking roof, foundation issues).

Wrong Features: Incorrect information about the number of bedrooms, bathrooms, or the inclusion of non-existent features or outbuildings.

Overvaluation (Exceeding Market Value)

The assessment is an estimate of fair market value as of January 1 of each year.

A successful appeal demonstrates the assessed value is higher than what the property would sell for on the open market.

Recent Sales Data: Evidence of recent sales (within the previous calendar year) of at least three similar properties in the same neighborhood that sold for less than the assessed value.

Independent Appraisal: A professional, third-party appraisal that indicates a lower market value.

Lack of Uniformity (Inequitable Assessment)

Appeals can succeed by showing that the property’s value is inconsistent with similar properties in the neighborhood, even if the general market value is correct.

Comparable Assessments: Providing assessment data for three or more similar, nearby properties that are valued at a lower rate per square foot or use a different, more favorable method of valuation.

Homeowners must provide clear documentation to support their claims, and neither financial hardship nor the general rate of value change in the market is considered sufficient grounds for an appeal on its own.

My advice is to fight it if it feels unfair!

To learn more contact Toby Beavers, one of the best Charlottesville real estate agents, to discuss the best Charlottesville neighborhoods.

Toby Beavers, a top Charlottesville realtor since 2003, may be reached by text or phone at 434-327-2999